A company can improve its return on common stockholders' equity through initiatives such as cost-cutting, increasing sales, optimizing asset utilization, or paying down debt. Each strategy aims to bolster profitability or efficiency, thus potentially enhancing the returns to common shareholders. This is because common shareholders’ equity is not a fixed number and can change, for example, if a company sells additional stock. The return on common shareholders' equity ratio is a financial metric that is used to measure a company’s ability to generate profits for equity investors. You can start by examining the balance sheet and income statement of a company to calculate its ROE ratio, which is equal to a company’s net income divided by its average shareholders’ equity. The return on common equity, or ROCE, is defined as the amount of profit or net income a company earns per investment dollar.

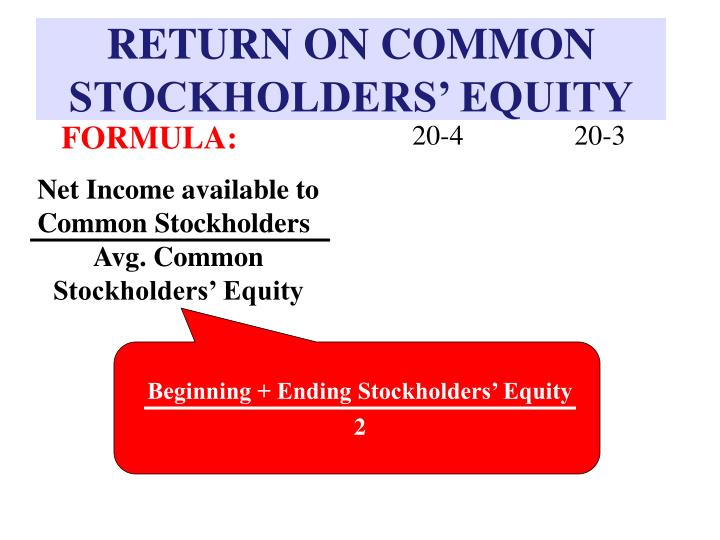

How does one calculate average equity?

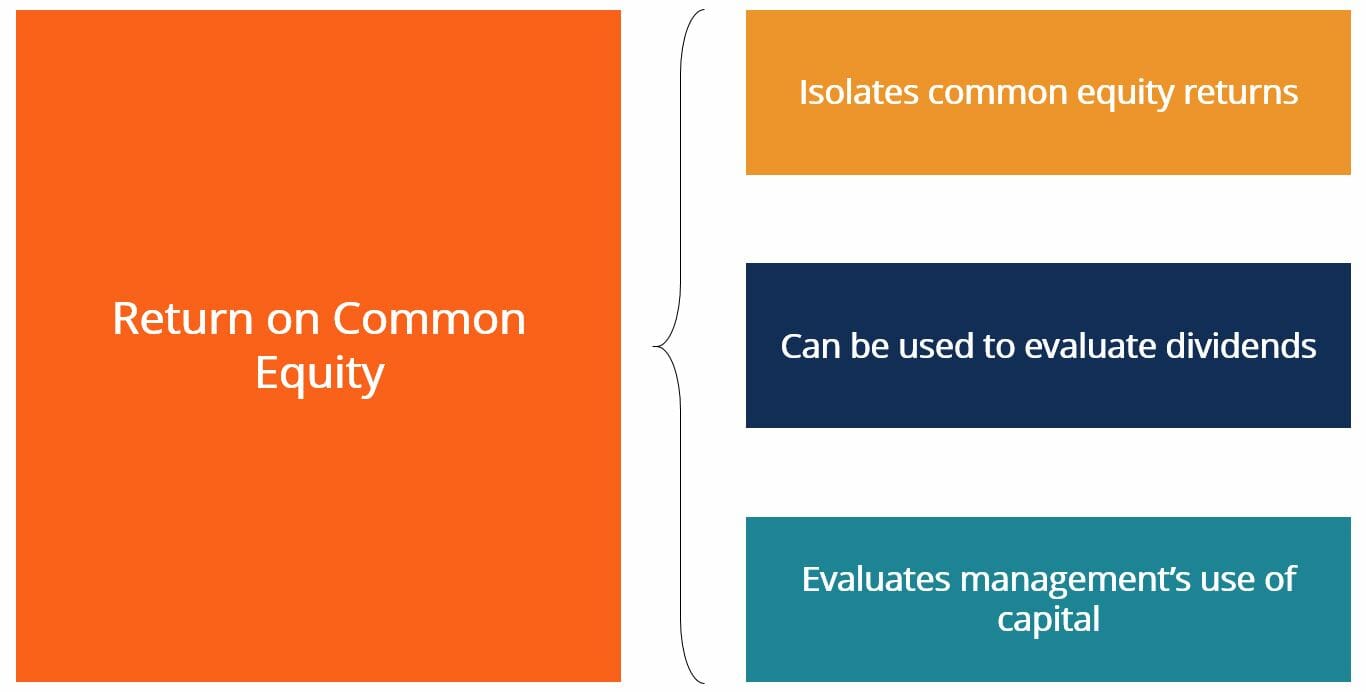

ROCE provides a measure of how efficiently a company utilizes its shareholders’ funds to generate profits. A higher ROCE indicates better utilization of equity capital and higher profitability, while a lower ROCE signifies lower profitability and inefficient use of shareholder’s equity. However, the interpretation of ROCE depends on the industry and economic conditions in which the company operates, as we will discuss in later sections. Return on Common Equity (ROCE) is a crucial financial ratio that measures a company’s ability to generate profits from its invested capital. Investors and analysts often use ROCE as an indicator of a company’s financial performance and management efficiency.

Benefits and limitations of using ROCE as a performance measure

The beginning and end of the period should coincide with the period during which the net income is earned. Relatively high or low ROE ratios will vary significantly from one industry group or sector to another. Ultimately, when computing ROE, it is essential to consider the denominator and the income a company generates from the shareholder’s equity.

How to Improve ROCE

ROCE is a crucial financial ratio that investors use to evaluate a company’s financial performance and profitability. A higher ROCE indicates that the company has a better capacity to generate profits with its available equity capital, which is a positive sign for investors. It shows that the company is efficiently utilizing its shareholder’s funds and has a better return on investment. However, a lower ROCE indicates that the company is less profitable and may not be utilizing its equity capital efficiently.

Return on Common Equity (ROCE)

If ROE is very high, then the firm has been doing exceptionally well in making profits with just a little capital invested. However, if it is low, then there might be something wrong with the decision making and the firm is not using its assets optimally. Liberated Stock Trader, founded in 2009, is committed to providing unbiased investing education through high-quality courses and books.

Moreover, debt is another factor that affects the return on common stockholders equity. If the return on common stockholders equity is high, that means you’re likely to see a higher return on your investment. ROCE (return on capital employed) is a ratio that indicates the profitability of the investment in which the whole employed capital of a company is engaged. Thanks to this fact, it is more useful when we want to analyze a company with long-term debt. Return on common equity is different from return on (total) equity in that it measures the return on common equity only rather the return on both the preferred equity and common equity. The issuance of $5m in preferred dividends by Company A decreases the net income attributable to common shareholders.

Return on common equity is a profitability ratio that measures dollars of net income available for distribution to common stock-holders per dollar of average book value of the common stockholders investment. Net income attributable to the common stockholders equals net income minus preferred dividends while common equity equals total shareholders equity minus preferred stock. Return indoor tanning on Common Equity (ROCE) is a crucial financial metric that evaluates a company’s profitability and management efficiency. By measuring the returns generated from equity capital, ROCE provides valuable insights into a company’s financial performance. Investors and analysts can utilize ROCE to assess profitability, compare industry benchmarks, and make informed investment decisions.

To estimate a company’s future growth rate, multiply the ROE by the company’s retention ratio. The retention ratio is the percentage of net income that is retained or reinvested by the company to fund future growth. Return on equity is also similar to earnings per share or EPS, which is a great way of tracking earnings across time.

- Each strategy aims to bolster profitability or efficiency, thus potentially enhancing the returns to common shareholders.

- The return on common stockholders equity ratio, also known as ROE, is a vital metric used for evaluating a company’s financial health.

- A company with a lower ROE but a solid balance sheet and steady growth potential may be a better investment than one with a higher ROE that has a high level of debt.

- The return on common shareholders' equity ratio is a financial metric that is used to measure a company’s ability to generate profits for equity investors.

Therefore, when evaluating an investment opportunity, examining a company’s ROE should be a part of the investment analysis process. When examining a company’s ROE, it’s important to consider excessive debt as it can have an adverse effect on the ratio. It’s a way to determine if a company is making enough money to justify the investment you’ve made in their stock.

Yet because EPS depends on the number of shares, it’s not easily comparable across different companies. We subtract preferred dividends from net income because by definition these dividends are not part of the returns that accrue to regular stockholders. It is important to compare a company’s return on equity to that of other companies within the same industry to determine whether it is performing well or not. Therefore, it is crucial to compare a company’s return on equity to that of other companies within the same industry. The average return on equity for the industry and the company’s past performance should be taken into account when calculating a company’s ROE.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.