Actual hours are the hours that the company’s workforce actually spends during the period or actually spends to complete a certain number of units of production. Remember that both the cost and efficiency variances, in this case, were negative showing that we were under budget, making the variance favorable. Even though the answer is a negative number, the variance is favorable because we used less indirect materials than we budgeted. Variable overhead efficiency variance refers to the difference between the true time it takes to manufacture a product and the time budgeted for it, as well as the impact of that difference.

How to Compute Various Overhead Cost Variances

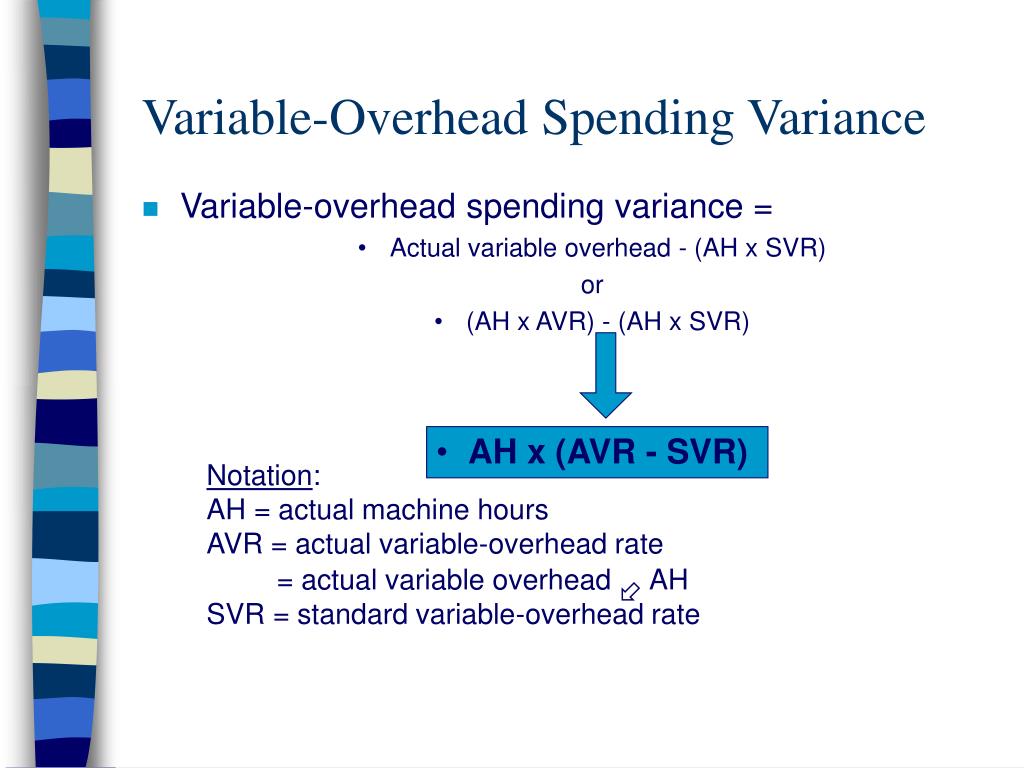

An unfavorable variable overheadefficiency variance is when the standard hours required for production are lessthan the actual hours worked. So, the company ABC has a $400 favorable variable overhead efficiency variance in September. This is due to the company ABC spends only 480 hours which is 20 hours less than the standard hours that are budgeted. Standard variable overhead rate is the rate that can be determined with the budgeted variable overhead cost dividing by the level of activity which in this case is either labor hours or machine hours. Variable Overhead Efficiency Variance is the measure of impact on the standard variable overheads due to the difference between standard number of manufacturing hours and the actual hours worked during the period. On the other hand when actual hours exceed standard hours allowed, the variance is negative and unfavorable implying that production process was inefficient.

Standard Cost for Actual Output (Variable Overhead)

To enable understanding we have worked out the illustration under the three possible scenarios of overhead being absorbed on output, input and period basis. Since the formula for this variance does not involve absorbed overhead, the basis of absorption of overhead is not a factor that influences the calculation of this variance. And that’s why the efficiency graph goes higherand in the end, the result is a favorable one. Variable overhead is an indirect production expense that varies based on production.

- Therefore, these variances reflect the difference between the Standard Cost of overheads allowed for the actual output achieved and the actual overhead cost incurred.

- Standard hours are the number of hours that the company’s workforce is expected to spend during the period or to spend in completing a certain number of units of production.

- (c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead.

- It is the difference between the actual hours worked and the standard hours required for budgeted production at the standard rate.

- Using the information given below, compute the fixed overhead cost, expenditure, and volume variances.

- Therefore a positive value is favorable implying that production process was carried out efficiently with minimal loss of resources.

Fixed Overhead Variance

This is a portion of volume variance that arises due to high or low working capacity. It is influenced by idle time, machine breakdown, power failure, strikes or lockouts, or shortages of materials and labor. This example provides an opportunity to practice calculating the overhead variances that have been analyzed up to this point.

What is expenditure variance?

If actual labor hours are less than the budgeted or standard amount, the variable overhead efficiency variance is favorable; if actual labor hours are more than the budgeted or standard amount, the variance is unfavorable. Variable Overhead Efficiency Variance is calculated to quantify the effect of a change in manufacturing efficiency on variable production overheads. As in the case of variable overhead spending variance, the overhead rate may be expressed in terms of labor hours or machine hours (or both) depending on the degree of automation of production processes. As the name suggests, variable overhead efficiency variance measure the efficiency of production department in converting inputs to outputs. Variable overhead efficiency variance is positive when standard hours allowed exceed actual hours. Therefore a positive value is favorable implying that production process was carried out efficiently with minimal loss of resources.

Favorable variable overhead efficiency variance indicates that fewer manufacturing hours were expended during the period than the standard hours required for the level of actual output. Variable overhead efficiency variance is favorable when the standard hours budgeted are more than the actual hours worked. This means that the company’s workforce which legal fees can you deduct on your taxes spends less time than budgeted to complete the production. In other words, the company is more efficient than expected in completing the task. An adverse variable overhead efficiency variance suggests that more manufacturing hours were expended during the period than the standard hours required for the level of actual production.

If the variance is significant, the company must take appropriate measures to reduce such overheads to a minimum. The standard rate is adjusted per all price-increasing/decreasing factors (inflation rate, different suppliers, etc). For example, the quantity of diesel oil utilized is estimated based on previous production units.

Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance. (c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead. Similarly, indirect labor salaries and wages, including factory supervisors and guards, are estimated.

Thus, the production department does the same and provides an estimate of production costs that will be incurred in the following year. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.