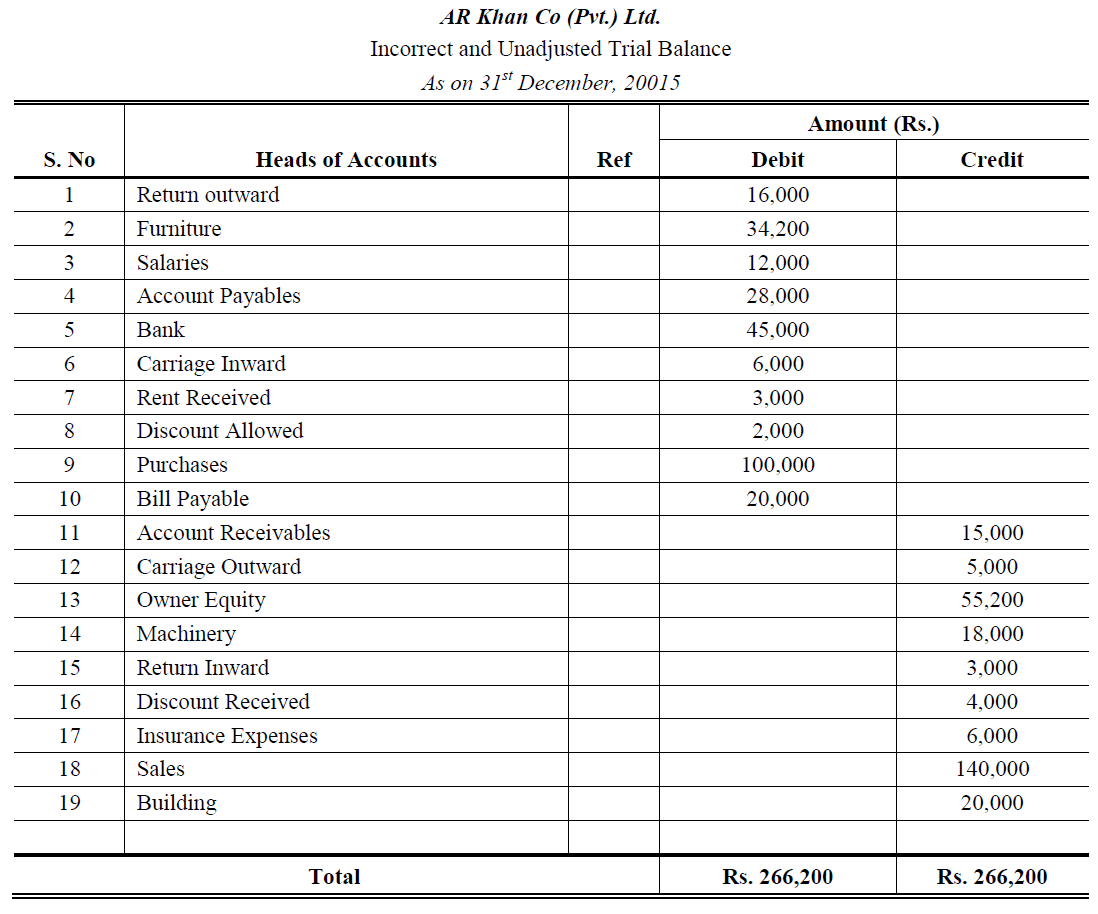

All three of these types have exactly the same format but slightly different uses. The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record of day-to-day transactions and can be used to balance a ledger by adjusting entries. Companies initially record their business transactions in bookkeeping accounts within the general ledger.

Financial Statements

- To getthe $10,100 credit balance in the adjusted trial balance columnrequires adding together both credits in the trial balance andadjustment columns (9,500 + 600).

- The trial balance information for Printing Plus is shownpreviously.

- Three columns are used to display the account names, debits, and credits with the debit balances listed in the left column and the credit balances are listed on the right.

- The preparation of the statement of cash flows, however, requires a lot of additional information.

That is because they juststarted business this month and have no beginning retained earningsbalance. There are no special conventions about how trial balances should be prepared, and they may be completed as often as a company needs them. A trial balance is often used as a tool to keep track of a company’s finances throughout the year, whereas a balance sheet is a legal statement of the financial position of a company at the end of a financial year. When you prepare a balance sheet, you must first have the most updated retained earnings balance. To get that balance, you take the beginning retained earnings balance + net income – dividends.

First method – inclusion of adjusting entries into ledger accounts:

To get the numbers in these columns, you take the number in thetrial balance column and add or subtract any number found in theadjustment column. There is no adjustment in the adjustment columns, so theCash balance from the unadjusted balance column is transferred overto the adjusted trial balance columns at $24,800. InterestReceivable did not exist in the trial balance information, so thebalance in the adjustment column of $140 is transferred over to theadjusted trial balance column. The trial balance information for Printing Plus is shownpreviously.

Preparing the Financial Statements

Ending retained earnings information is taken from the statementof retained earnings, and asset, liability, and common stockinformation is taken from the adjusted trial balance asfollows. A company’s transactions are recorded in a general ledger and later summed to be included in a trial balance. In these columns we record all asset, liability, and equity accounts. Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from the posted adjusted journal entries.

You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575. When entering net income, it should be written in the column with the lower total. You then add together the $5,575 and $4,665 to get a total of $10,240. If you review the income statement, you see that net income is in fact $4,665.

What is an unadjusted trial balance?

If we go back and look at the trial balance for PrintingPlus, we see that the trial balance shows debits and credits equalto $34,000. Once all balances are transferred to the adjusted trial balance,we sum each of the debit and credit columns. The debit and creditcolumns both total $35,715, which means they are equal and inbalance. Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

Depending on the kinds of business transactions that have occurred, accounts in the ledgers could have been debited or credited during a given accounting period before they are used in a trial balance worksheet. Furthermore, some accounts may have been used to record multiple business transactions. As a result, the ending balance of each ledger account as shown in the trial balance worksheet is the sum of all debits and credits that have been entered to that account based on all related business transactions. A trial balance is an accounting report that lists the ending balances of general ledger accounts to ensure the debit and credit balances are equal. In the Printing Plus case, the credit side is the higher figureat $10,240.

To exemplify the procedure of preparing an profit and loss aptitude questions and answers, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. To simplify the procedure, we shall use the second method in our example. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger.

Depreciation is a non-cash expense identified to account for the deterioration of fixed assets to reflect the reduction in useful economic life. The next type of adjustment is the accrual, which ensures inclusion of the future payments that the business entity is entitled to make. Such expenses might include paying for a rented space or any upcoming payments in the queue. If you use accounting software, this usually means you’ve made a mistake inputting information into the system. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution.

However it does not provide enough information for the preparation of the statement of cash flows. Adjusted trial balance is a list that shows all general ledger accounts and their balances after all adjusting entries have been made. Similar to the unadjusted trial balance, the total of debit balances must equal the total of credit balances in the adjusted trial balance.

You will not see a similarity between the 10-column worksheet and the balance sheet, because the 10-column worksheet is categorizing all accounts by the type of balance they have, debit or credit. You may notice that dividends are included in our 10-column worksheet balance sheet columns even though this account is not included on a balance sheet. There is actually a very good reason we put dividends in the balance sheet columns. If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, meaning the company did not make or lose any money.