The asset turnover ratio is a financial metric that evaluates how effectively your business uses its assets to produce revenue. If your AR turnover ratio is low, adjustments should be made to credit and collection policies—effective immediately. The longer you let it go, the harder it will be on positive business cash flow.

Example 3: Analyzing Asset Utilization with Asset Turnover Ratio

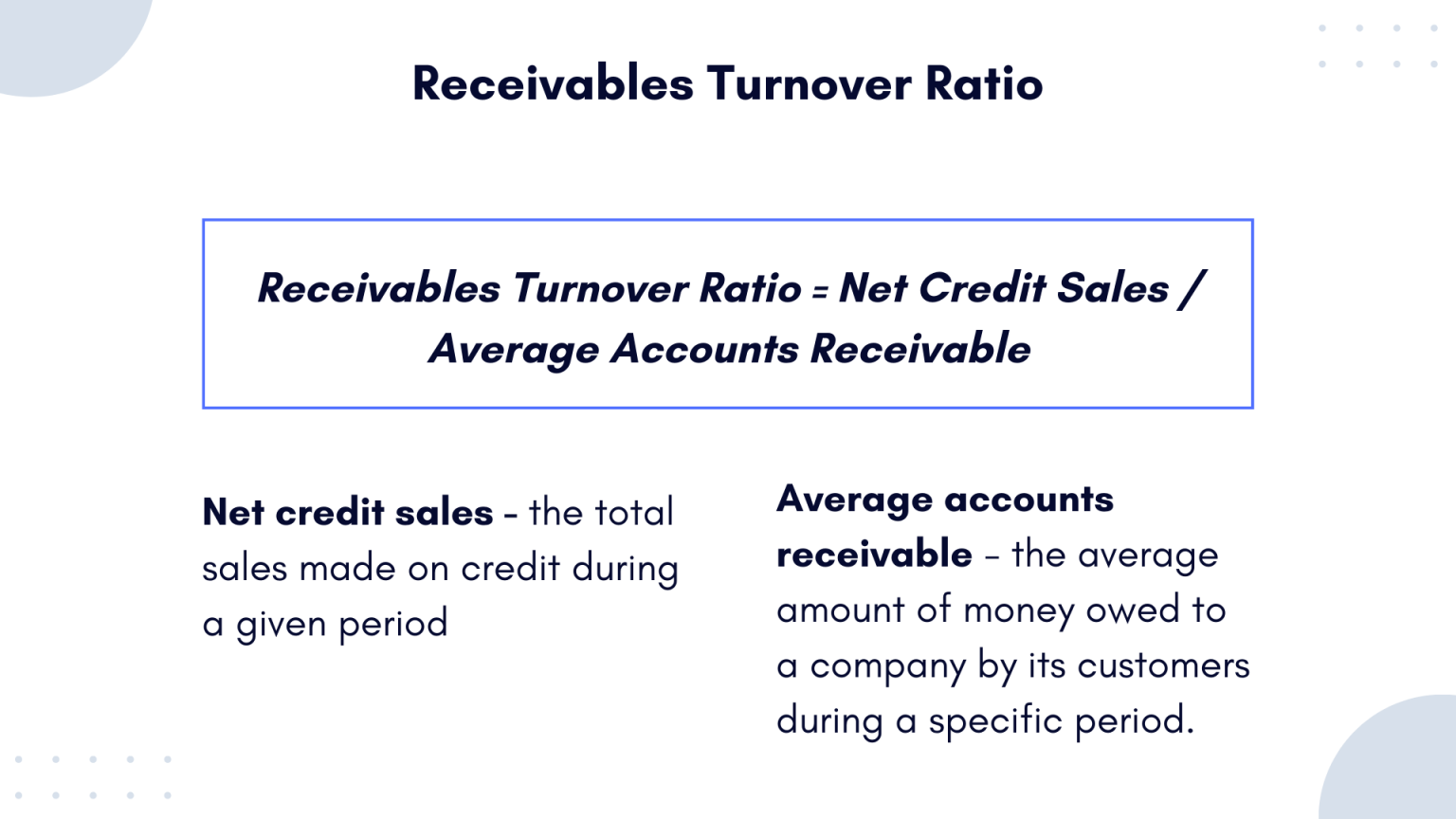

In this section, we’ll look at Alpha Lumber’s (fictional) financial data to calculate its accounts receivable turnover ratio. Then, we’ll discuss what the company’s ratio says about its current status and identify areas for improvement. To identify your average collection period, divide the number of days in your accounting cycle by the receivables turnover ratio. As can be seen from the receivable turnover ratio formula, this financial metric has quite a simple equation. The higher the number of days it takes for customers to pay their bills results in a lower receivable turnover ratio.

Low Accounts Receivable Turnover Ratio

It also serves as an indication of how effective your credit policies and collection processes are. The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently your company collects revenue. An accounts receivable turnover ratio of 12 means that your company collects receivables 12 times per year or every 30 days, on average. The accounts receivable turnover ratio measures the number of times a company’s accounts receivable balance is collected in a given period.

Our Services

Let us understand the concept of the accounts receivable turnover ratio through the example of one of the largest consumer goods companies in the world- Colgate. Implementing automation into your AR process can save you time and effort in collecting payments. With automation you can improve your accuracy and speed in sending invoices, and you can streamline and add visibility to your AR collection process. Sending reminders to customers helps keep them on track of paying on time. A friendly reminder can help to improve relationships and get payments quicker. If you have outstanding receivables, reminders can also help to collect payments from customers who are overdue.

Accounts Receivable Turnover Ratio: Meaning, Formula, Examples

One of the prime drivers is how efficient a company is in maximizing their assets and managing inventory. Several factors impact how companies calculate and interpret their asset turnover ratio. Keep copies of all invoices, receipts, and cash payments for easy reference. And create records for each of your vendors to keep track of billing dates, amounts due, and payment due dates.

Rare Coins Worth Hundreds That Are Highly Coveted by Coin Collectors

- However, the time it takes to receive payments often varies from quarter to quarter, especially for seasonal companies.

- Tracking this ratio can help you determine if you need to improve your credit policies or collection procedures.

- If you have some efficient clients who are always on time with their payments, reward them by offering some discounts which will help attract more business without affecting your receivable turnover ratio.

- If Alpha Lumber’s turnover ratio is high, it may be cause for celebration, but don’t stop there.

- Get the latest news on investing, money, and more with our free newsletter.

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology. Here are some examples in which an average collection period can affect a business in a positive or negative way. The AR balance is based on the average number of days in which revenue is received. Revenue in each period is multiplied by the turnover days and divided by the number of days in the period.

By using this ratio, companies can evaluate their productivity in using assets that are on hand. GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site.

Whether you use accounting software or not, someone needs to track the money in and money out. The faster you catch a missed payment, the faster, and more likely, gross sales vs net sales: whats the difference your customer is to pay. If your AR turnover ratio is low, you probably need to make some changes in credit and collection policies and procedures.

0 Comments